bradford tax institute cost

I always enjoy learning more to help both my practice and my clients and their articles seem to. I have been a subscriber for a few years and have always enjoyed and valued the emails and newsletters.

Bradford Tax Institute Facebook

Helps you become the agency or brokerage employer of choice in your marketplace.

. Murray Bradford in 1991 Bradford Tax Institute is the. I decided to sign up for a webinar they were holding. 1050 Northgate Drive Suite 351.

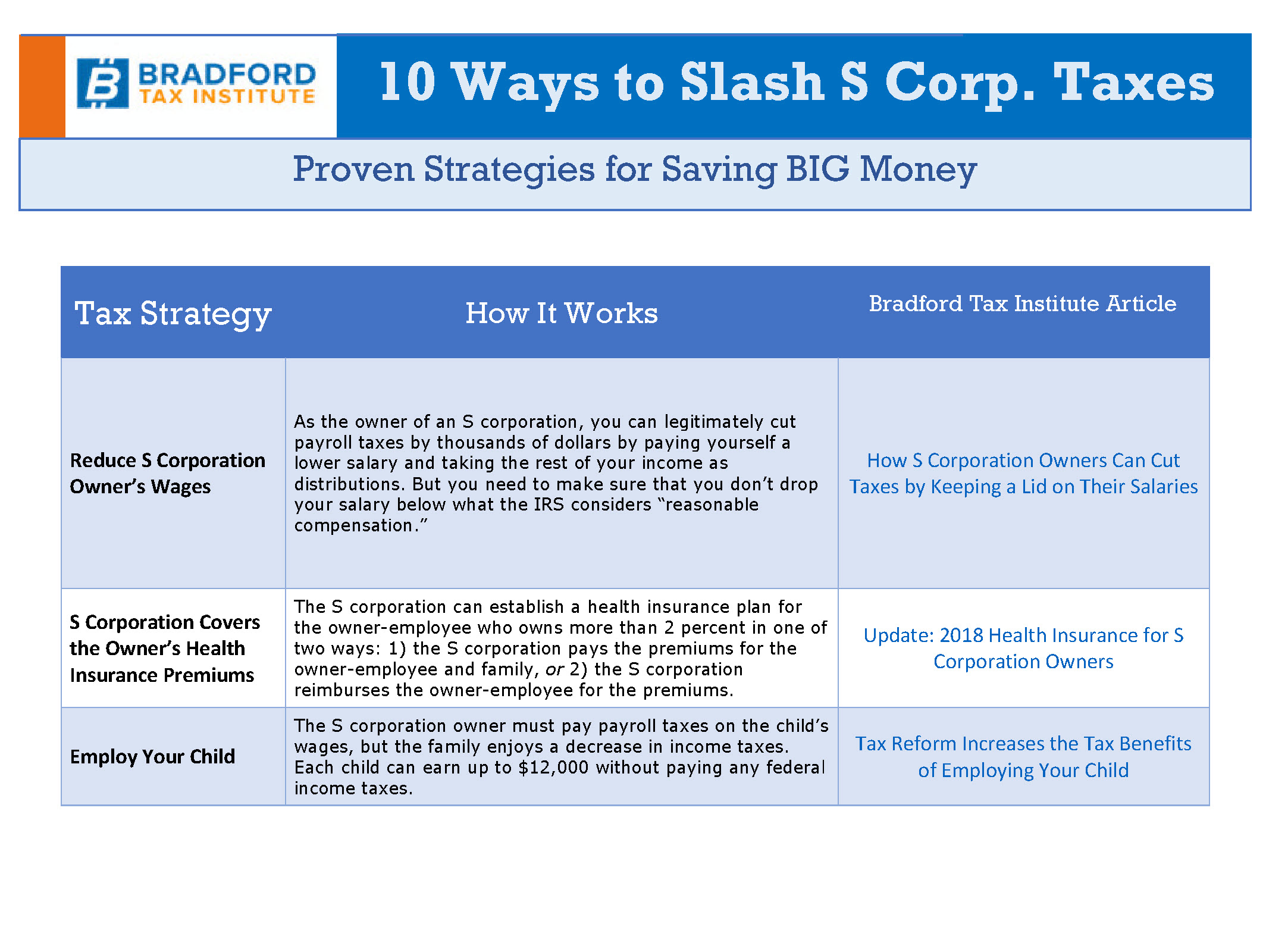

Bradford Tax Institute provides proven tax reduction strategies for one-owner and husband-and-wife-owned businesses. We tried scrapping a short paragraph. But to claim the full.

The tax ideas strategies and tips at this site come from the Tax Reduction Letter. Bradford Tax Institute Cost - Tax Reduction Letter Tax Smart Solutions For The Self Employed - Not available archived webinars do not offer cpe credits. San Rafael CA 94903.

1050 Northgate Drive Suite 351. San Rafael CA 94903. Expense Reports for Clients.

San Rafael CA 94903. No wonder hundreds of associations clubs and agencies over the past 40 years have used Bradford Tax Seminars to help their members and agents become more prosperousin turn. If you buy an all-electric vehicle or a plug-in hybrid electric vehicle you can qualify for a tax credit worth up to 7500.

1050 Northgate Drive Suite 351. 9 long-playing professionally recorded CDs in a handsome carrying case that turns your car into a tax-savings university so you can learn the most. So far no complaints.

The Bradford Tax Institute dedicates itself to helping you pay less in taxes and be less afraid of an IRS audit. Bradford is the nations pre-eminent tax reduction expert having. Sounds simple enough doesnt it.

Apd1987 1 yr. The Tax Reduction Letter is published by the Bradford Tax Institute which was founded by W. Each issue is written for you but fully referenced for the most sophisticated tax professional.

The 50-gallon 339 UEF AeroTherm heat pump water heater using 958 kWh per year and national average electricity rate of 12 cents per. Well explain the importance of Revenue Ruling 70-393. This educational seminar helps build your reputation as the best real estate company in your area to.

The ruling states that the monies spent to outfit and support your team are similar to monies spent on other methods of. Tax Reduction Letter is dedicated to increasing your net worth as a self-employed taxpayer. Murray Bradford in 1991.

Savings based on the estimated annual. Find a Tax Advisor. I recently subscribed to Bradford Tax Institute.

Florida Property Tax H R Block

Bradford Tax Institute Facebook

Tag Archive Earned Income Tax Credit American Enterprise Institute Aei

Individual Income Tax The Basics And New Changes St Louis Fed

![]()

Nc State Local Tax Conference Event Schedule

Individual Income Tax The Basics And New Changes St Louis Fed

Tax Equivalences And Their Implications Tax Policy And The Economy Vol 33

Amazon Com How To Beat The Irs With Tax Saving Business Strategies 9781790810123 Zubler David C Books

The 651 958 00 Email Series Membership And Subscription Growth

The Practical Guide To S Corporation Taxes Lifetime Paradigm

W Murray Bradford Cpa President Bradford Tax Institute We Produce The World S Definitive Tax Tips And Strategies Publications San Francisco Bay Area Linkedin

Randy Luebke Author At Lifetime Paradigm

263a Form Fill Out Sign Online Dochub

Tax Cuts Jobs Act Tcja H R Block

Individual Income Tax The Basics And New Changes St Louis Fed

The Practical Guide To S Corporation Taxes Lifetime Paradigm